What is Sensitivity Analysis? Sensitivity Analysis is defined as the strategy made use of to determine just how various values of an independent variable will certainly affect a certain dependent variable under an offered collection of presumptions. It is made use of within specific borders that will certainly depend on one or more input variables, such as the impact that transforms in rate of interest will carry a bond’s price.

It is additionally referred to as the what– if analysis. Sensitivity analysis could be used for any task or system. All from intending a family trip with the variables in mind to the choices at corporate levels could be done with sensitivity analysis.

It aids in analyzing exactly how delicate the result is, by the changes in one input while keeping the various other inputs constant.

Sensitivity analysis works on the straightforward concept: Adjustment the design and observe the actions.

The specifications that needs to keep in mind while doing the above are:

A) Speculative style: It consists of mix of criteria that are to be differed. This consists of an examine which and also the number of parameters should vary at a provided point, assigning worths (optimum and also minimum degrees) before the experiment, research the relationships: favorable or negative and also as necessary designate worths for the combination.

B) Exactly what to differ: The various specifications that can be decided to vary in the model could be:

- the number of tasks

- the objective in relation to the threat thought and the profits anticipated

- technical criteria

- variety of constraints as well as its limits

C) What to observe:

- the worth of the objective based on the strategy

- worth of the decision variables

- worth of the objective feature between 2 strategies embraced

Measurement Of Sensitivity Analysis

Below are discussed the actions made use of to carry out sensitivity analysis:

- Firstly the base situation outcome is defined; claim the NPV at a particular base situation input worth (V1) for which the sensitivity is to be gauged. All the various other inputs of the design are kept consistent.

- Then the value of the result at a new value of the input (V2) while maintaining other inputs continuous is computed.

- Find the portion adjustment in the result and also the percentage adjustment in the input.

- The sensitivity is determined by separating the percentage change in outcome by the portion adjustment in input.

This procedure of testing sensitivity for an additional input (state capital growth price) while maintaining the rest of inputs constant is repeated till the sensitivity figure for each of the inputs is acquired. The final thought would certainly be that the higher the sensitivity number, the much more sensitive the outcome is to any modification in that input and also vice versa.

Methods of Sensitivity Analysis

There are various techniques to execute the sensitivity analysis:

- Modeling and also simulation techniques

- Scenario management tools through Microsoft excel

There are mainly two approaches to analyzing sensitivity:

- Local Sensitivity Analysis

- Global Sensitivity Analysis

Local sensitivity analysis is derivative based (mathematical or logical). The term regional suggests that the derivatives are taken at a single point. This technique fits for basic cost functions, yet not viable for intricate versions, like designs with discontinuities do not constantly have derivatives.

Mathematically, the sensitivity of the price function relative to specific criteria is equal to the partial by-product of the expense feature relative to those criteria.

Local sensitivity analysis is a one-at-a-time (OAT) method that analyzes the influence of one specification on the price feature at a time, maintaining the various other parameters taken care of.

Global sensitivity analysis is the second method to sensitivity analysis, frequently carried out using Monte Carlo strategies. This technique uses a worldwide set of samples to explore the style area.

The numerous techniques widely used include:

- Differential sensitivity analysis: It is likewise described the direct method. It includes resolving easy partial derivatives to temporal sensitivity analysis. Although this approach is computationally effective, addressing equations is extensive task to deal with.

- One at a time sensitivity steps: It is the most basic technique with partial distinction, in which varying criteria worths are taken one by one. It is additionally called as local analysis as it is a sign only for the attended to point quotes and also not the entire circulation.

- Factorial Analysis: It involves the option of given variety of samples for a details parameter and afterwards running the model for the mixes. The outcome is after that made use of to carry out parameter sensitivity.

Via the sensitivity index one can calculate the result % difference when one input criterion varies from minimum to maximum value.

- Correlation analysis helps in specifying the relation in between independent and dependent variables.

- Regression analysis is a thorough approach utilized to obtain responses for complicated versions.

- Subjective sensitivity analysis: In this approach the private parameters are analyzed. This is a subjective approach, simple, qualitative and an easy approach to eliminate input parameters.

Utilizing Sensitivity Analysis for choice production

Among the essential applications of Sensitivity analysis is in the application of designs by supervisors and decision-makers. All the content needed for the decision version could be totally used just through the repeated application of sensitivity analysis. It aids decision experts to recognize the uncertainties, benefits and drawbacks with the constraints as well as range of a decision version.

Most if not all choices are made under uncertainty. It is the optimum solution in choice making for various parameters that are approximations. One approach to find to conclusion is by changing all the uncertain criteria with anticipated values and after that accomplish sensitivity analysis. It would certainly be a rest for a decision manufacturer if he/ she has some indicator regarding exactly how sensitive will certainly the choices be with changes in one or more inputs.

Use Sensitivity Analysis

- The essential application of sensitivity analysis is to show the sensitivity of simulation to unpredictabilities in the input values of the model.

- They aid in decision making

- Sensitivity analysis is an approach for forecasting the result of a choice if a scenario ends up being various compared to the crucial predictions.

- It assists in examining the riskiness of a method.

- Assists in identifying how reliant the output gets on a particular input worth. Analyses if the dependency then helps in analyzing the danger associated.

- Aids in taking enlightened as well as ideal choices

- Aids looking for mistakes in the design

Conclusion

Sensitivity analysis is just one of the tools that assist decision manufacturers with more than a remedy to a trouble. It provides an ideal understanding into the problems connected with the design under reference. Lastly the choice maker obtains a suitable idea concerning how delicate is the optimal service picked by him to any adjustments in the input values of several criteria.

The Function of Sensitivity Analysis

In a sensitivity analysis, only the undesirable adjustments are represented to consider the influence of these changes on the productivity of the project. The sensitivity analysis serves complying with functions:

– It assists in recognizing the key variables that are significant impact in the price and also benefits of the project. Needs, expenditures, operating expenses and legal expenses, earnings and also financial benefits are included in this phase.

– It additionally helps in figuring out the consequences of the unpleasant amends in these vital variables.

– It likewise assists entities to evaluate whether these changes will certainly impact the task decisions made.

– This method additionally assists in determining as well as executing the activities that will assist minimize these negative impacts.

Efficiency of Sensitivity Analysis

In order to enhance the energy of the sensitivity analysis, it needs to be performed in a methodical way. To optimize the efficiency, entities could adhere to following steps:

– Identification of the sensitive variables which impact the task decision

– Estimation of the results of these adjustments

– Consideration of the variables in possible combinations that could be altered at the same time

What-If analysis

corporatefinanceinstitute.com

A Financial Sensitivity Analysis, likewise known as a What-If analysis or a What-If simulation workout, is most generally used by monetary experts to predict the end result of a particular activity when performed under certain conditions.

Financial Sensitivity Analysis is done within specified boundaries that are identified by the set of independent (input) variables.

For instance, Sensitivity Analysis could be made use of to examine the result of an adjustment in interest rates on bond prices if the rate of interest boosted by 1%. The “What-If” question would certainly be: “Just what would certainly happen to the rate of a bond If rates of interest went up by 1%?”. This question is responded to with sensitivity analysis.

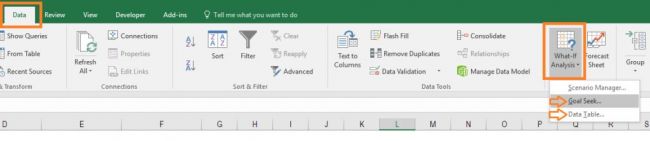

The analysis is done in Excel under the Data area of the ribbon and the “What-if Analysis” switch, which includes Goal Seek as well as Data Table. These are both instructed detailed in our totally free Excel Refresher course.

Sensitivity analysis example

corporatefinanceinstitute.com

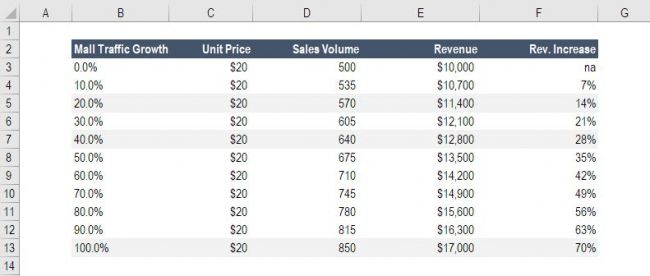

John is in charge of sales for HOLIDAY Carbon Monoxide that offers Xmas decors at a shopping mall. John recognizes that the holiday is approaching which the mall will be crowded. He wants to learn whether a rise in customer website traffic at the mall will increase the overall sales profits of VACATION Carbon Monoxide and also if so, by how much.

The typical price of a packet of Xmas designs is $20 as well as during the previous year’s holiday, VACATION CO sold 500 packs of Christmas decors, leading to total sales worth $10,000.

After executing an Economic Sensitivity Analysis, John determines that a 10% rise in consumer web traffic at the shopping center causes a 7% rise in the number of sales.

Using this info, John could predict how much money firm XYZ will certainly generate if client website traffic rises by 20%, 40%, or 100%.

Based upon John’s Financial Sensitivity Analysis, these will certainly lead to an increase in earnings by 14%, 28%, and also 70% specifically.

Discover how you can construct a table like this in our Free Excel Crash Course!

Sensitivity Analysis vs Situation Analysis

It is important not to puzzle an Economic Sensitivity Analysis with a Financial Scenario Analysis Although much like some degree, both have some crucial distinctions.

Sensitivity Analysis is made use of to comprehend the effect of a set of independent variables on some reliant variable under particular problems. For instance, a financial analyst wishes to find out the effect of a business’s web capital on its profit margin. The analysis will certainly involve all the variables that have an effect on the company’s revenue margin such as the expense of goods marketed, workers’ earnings as well as supervisors’ wages, etc. The analysis will isolate each of these dealt with and variable costs and record all the feasible results.

Scenario Analysis, on the other hand, would certainly require the economic analyst to describe a specific situation in detail. Circumstance Analysis is typically done to assess situations including significant shocks such as a global market shift or a major change in the business.

After specifying the details of the circumstance, the analyst would certainly after that need to define all the variables within the situation so that they straighten with the scenario. The result is a very comprehensive photo of the situation. The analyst would understand the complete variety of results, given all the extremes, and would have an understanding of exactly what the outcomes would be, provided a particular collection of variables specified by a specific real-life scenario.

Advantages of Financial Sensitivity Analysis

Sensitivity Analysis includes reputation to any kind of kind of financial design by checking the model throughout a vast collection of possibilities.

Financial Sensitivity Analysis permits the expert to be adaptable with the borders within which to evaluate the sensitivity of the dependent variables to the independent variables. As an example, the design to examine the effect of a 5-point modification in rate of interest on bond costs would be different from the financial model that would be utilized to study the effect of a 20-point change in rates of interest on bond prices.

A sensitivity analysis aids one make notified options. Decision-makers utilize the model to comprehend exactly how responsive the outcome is to changes in particular variables. This partnership could aid an analyst in acquiring substantial verdicts as well as be instrumental in making optimum choices.

Exactly what are sensitivity analysis best practices?

Format in Excel

corporatefinanceinstitute.com

Design, structure, and planning are very important forever sensitivity analysis in Excel. If a version is not well organized both the developer and individuals of the model will be perplexed and the analysis will be susceptible to mistake.

One of the most vital indicate remember for format in Excel include:

- Place all presumptions in one area of the version

- Layout all assumptions/inputs in an unique typeface color so they are simple to recognize

- Think meticulously concerning what to test– only the most crucial assumptions

- Understand the partnership (connection) between dependent and independent variables (linear, nonlinear?).

- Produce charts and graphs that permit individuals to picture the data.

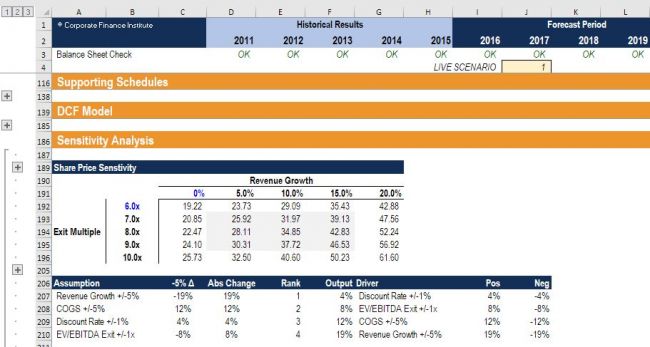

- Produce a separate area for the analysis utilizing grouping (see example listed below).

Direct versus indirect approaches

corporatefinanceinstitute.com

The straight technique entails replacing various numbers right into a presumption in a version.

For example, if the income growth presumption in a version is 10% year over year (YoY), then the revenue formula is = (in 2014 profits) x (1 + 10%). In the direct technique, we replace various numbers to replace the growth rate, like 0%, 5%, 15%, and 20% as well as see exactly what the resulting profits bucks are.

The indirect technique (as shown below) inserts a percent become formulas in the model, rather than straight transforming the value of a presumption.

With the same example as above, if the income development presumption in a design is 10% year over year (YoY), after that the income formula is = (in 2014 income) x (1 + 10%). Instead of transforming 10% to other number, we could change the formula to be = (in 2014 revenue) x (1 + (10% + X)). Where X is a worth included down in the sensitivity analysis location of the model.

Tables, graphes, and also charts.

Sensitivity analysis could be challenging to understand also by the most informed and also practically smart financing professionals, so it is essential to be able to express the lead to a manner that’s very easy to comply with.

corporatefinanceinstitute.com

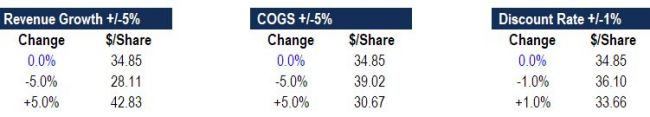

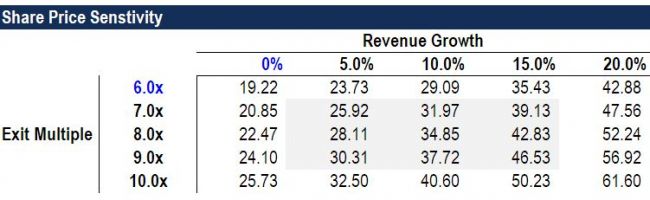

Data tables are a great method of showing the effect on a reliant variable by altering to 2 independent variables. Below is an example of a data table that clearly shows the impact of modifications in income development as well as EV/EBITDA numerous on a business’s share rate.

corporatefinanceinstitute.com

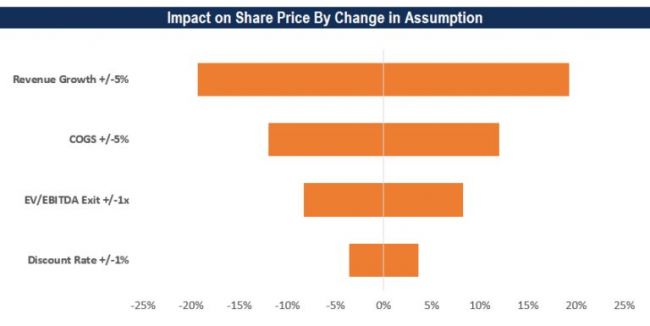

Tornado Charts can be a fantastic way of showing the effect of modifications to lots of variables simultaneously. They are called Tornado Charts since they are sorted from one of the most impactful to least impactful in such a way that shapes the chart like a twister cone.

Originally posted 2017-11-28 07:22:44.